Q2 2025 AgTech Venture Capital Investment and Exit Round Up

Last quarter, our analysis of Crunchbase data shows 149 AgTech startups raised a total of $1.55B writes market expert Kyle Welborn at CropLife. This represents a 16% decline in funding and a 20% decline in deals from Q1 2025. There were 11 AgTech exits last quarter, all through M&A transactions.

Key Takeaways from Last Quarter

AgTech’s decline in venture activity last quarter mirrors broader caution in global venture capital markets. AgTech investments accounted for approximately 1.64% of the $94.6 billion in total VC funding globally, a slight increase in share from Q1 2025.

The number of deals declined notably quarter-over-quarter, but funding was propped up by several large rounds. The ten largest financings accounted for 55% of all AgTech dollars raised last quarter. Notably, drone technology and AI-powered platforms featured heavily among these top investments.

A close look at the three startups that raised the most money last quarter — Quantum‑Systems, Cambrian Innovation, and SAEL — shows that while each has some exposure to agriculture, none is exclusively focused on the sector. Instead, they also serve industries such as clean energy and military intelligence. Meanwhile, investors focused specifically on AgTech innovations are participating in smaller rounds and emphasizing capital efficiency. AgTech startups are now expected to reach profitability more quickly and operate with greater financial discipline.

MORE BY CROPLIFE

A Return to ROI: Raven Industries’ Ben Sheldon on Tech Adoption in Uncertain Times

Exit activity also remained subdued but included a few strategic acquisitions from larger ag corporates such as John Deere and Syngenta. Despite muted conditions, acquisitions of companies like Sentera and Lavie Bio show that established strategics continue to seek growth through technology acquisitions.

AgTech Venture Investments

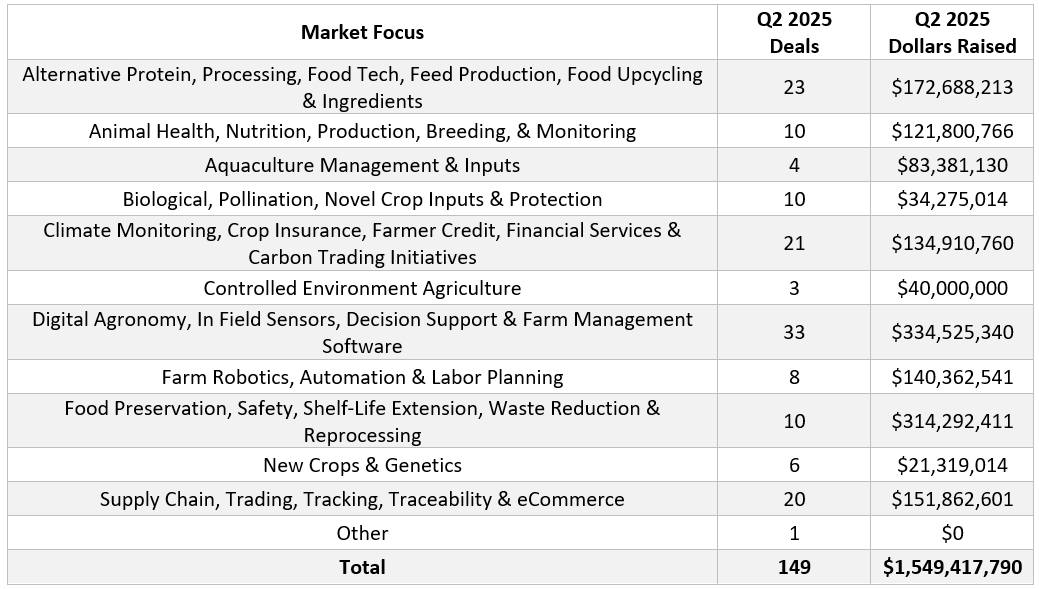

Below is a breakout of the deals and dollars that flowed to different sectors of AgTech last quarter:

Read more at CropLife.

Read more at CropLife.