2022 AgTech Venture Capital Investment and Exit Roundup

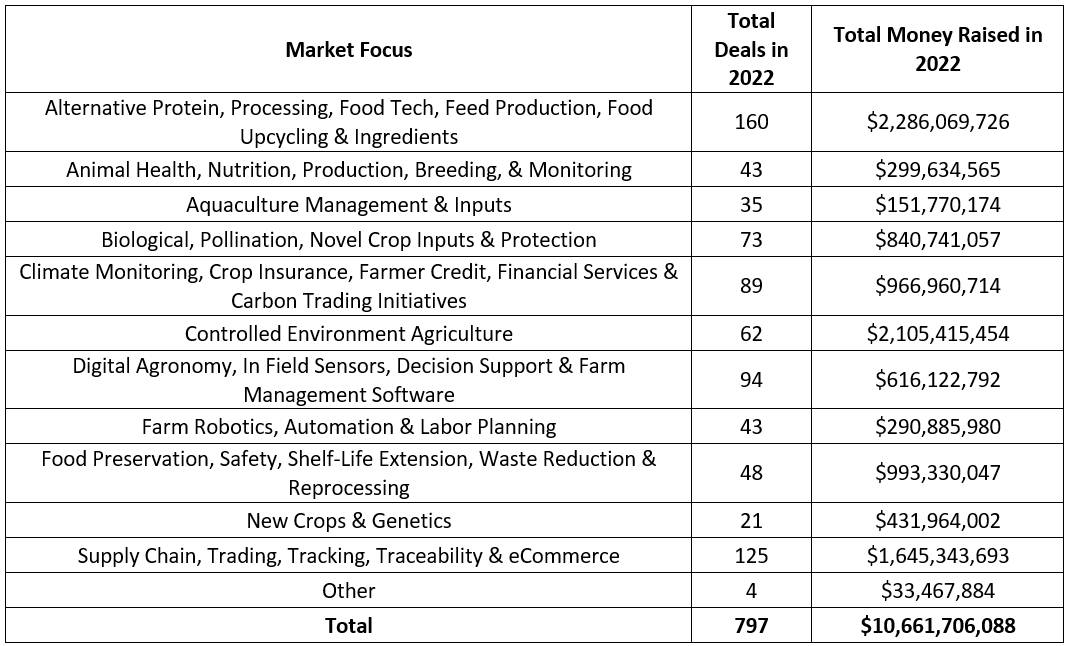

Last year, our analysis of Crunchbase data shows 797 AgTech startups globally raised $10.66B, writes Kyle Welborn at CropLife. This represents a 13% drop in funding, but a 26% increase in deals from 2021. Startups in all industries raised $445B in 2022, which represented a 35% decline from 2021. Investments into AgTech startups held up much better than in most industries. Last year AgTech venture capital investments made up about 2.4% of total startup investments.

There were 33 AgTech exits in 2022, 32 through M&A and one through a public listing. This is a 25% decline in exit activity from 2021. However, the number of exits through M&A was just one shy of the 2021 number at 33, while the number of public listings plummeted from 11 in 2021 to just one last year.

AgTech Venture Investments

Below is a breakout of the deals and dollars that flowed to different sectors of AgTech last year:

The largest increase in investment dollars by category was in the Controlled Environment Agriculture sector which saw over $700M of additional capital invested in 2022 than was invested in 2021. However, the top eight deals in that category raised over 80% of all its funding, so a few indoor farming projects were responsible for most of the increase. The other large increase by dollars from 2021 was in the climate monitoring and carbon trading category, which grew by over $490M last year.