Q3 2022 AgTech Venture Capital Investment and Exit Round Up

Last quarter, our analysis of Crunchbase data shows 201 AgTech startups raised a total of $2.6B, writes Kyle Welborn at CropLife. This represents a 5% drop in funding and a 3% decrease in deals from Q2 2022. Overall, the AgTech sector fared much better than venture capital investments across all industries which endured a 33% quarter-over-quarter reduction in funding, according to Crunchbase News. There were 10 AgTech exits last quarter, all through M&A transactions. This represents a 67% increase in the number of exits from Q2 2022.

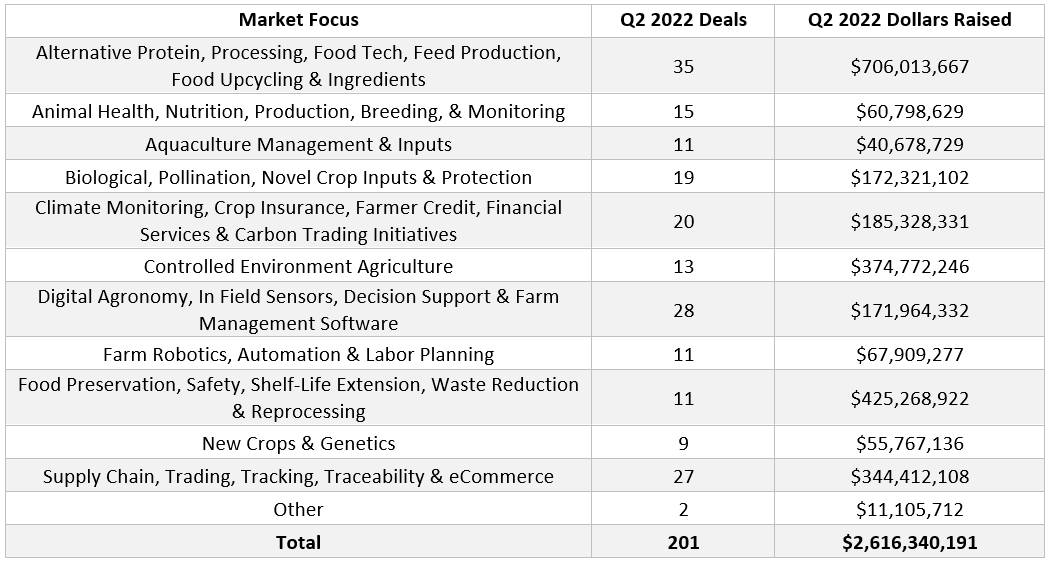

AgTech Venture Investments

Below is a breakout of the deals and dollars that flowed to different sectors of AgTech last quarter:

The biggest increase in total investment dollars quarter-over-quarter was in the food waste sector, where companies raised $391M more than they did in Q2 2022. The largest category drop in total investment dollars was in the controlled environment agriculture sector, where companies raised $312M less than in Q2 2022. The average AgTech investment round last quarter shrunk to $13M, down from $19.3M in 2021.