Study: U.S. Precision Agriculture Suppliers Come in All Shapes, Sizes, Ages

In a field that’s both 30-40 years old and also perpetually new, precision agriculture suppliers can range from the granddaddies of farm equipment to the latest startup in somebody’s garage.

How can someone possibly get a handle on the emerging structure of the U.S. precision agriculture industry?

If you’re J.R. McFadden and D.E. Schimmelpfennig, researchers with USDA’s Economic Research Service (USDA-ERS), you start with a wide-ranging directory of U.S. precision suppliers compiled and published right here on PrecisionAg in 2017 and drill down further to find both common and converging characteristics among suppliers.

McFadden’s and Schimmelpfenning’s findings were presented in July at the 12th European Conference on Precision Agriculture (ECPA), which attracted 380 attendees from 37 countries to Montpelier, France. Their report also is available through proceedings of this year’s ECPA, published by Wageningen Academic Publishers in the Netherlands.

MORE BY JAMES C. SULECKI

How Chateau Ste. Michelle Harvests Two Grades of Winegrapes — from One Vineyard

Here are highlights:

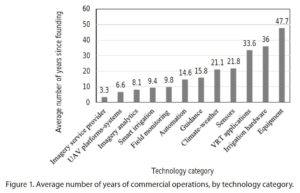

Age (Figure 1). Traditional equipment companies were, not surprisingly, the longest-operating companies at an average age of nearly 48 years, followed by irrigation hardware (36) and variable-rate technology suppliers (33.6). On the young end of the age spectrum were imagery service providers at an average of only 3.3 years of age, followed by UAV platforms/systems (6.6) and imagery analytics (8.1). Between these extremes, the authors note, are automation and guidance – technologies that began to be commercialized in the early 2000s.

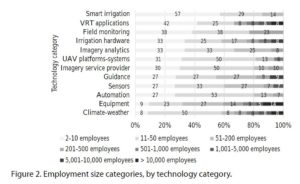

Size (Figure 2). The authors found that most of the suppliers across all technology sectors are relatively small, with a modal size category for 63 firms of 11-50 employees. Among the smallest were smart irrigation and field monitoring companies specializing in IoT solutions. “The largest companies,” the authors write, “produce guidance systems, climate-weather predictions, and input applications equipment. Many of these companies also manufacture large tractor and combine machinery, requiring sizable staffing in engineering, operations research, supply-chain management, and human resource departments.”

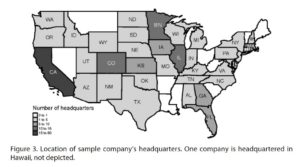

Location (Figure 3). McFadden and Schimmelpfenning found that precision agriculture companies are headquartered in at least 38 U.S. states, but are highly geographically concentrated. For instance, nearly one-third (29%) are headquartered in California, which as the authors note “has significant specialty crop area – typically requiring irrigation and specialized machinery – and an ample supply of engineers, computer programmers, software designers, and data scientists.” Among California firms, 80% were imagery service providers, 66% provided imagery systems, 60% UAV produced control platforms and input efficiency, and 40% were in automation.

Massachusetts – like California, a center of tech expertise and employees – was home to roughly 7% of the sample companies, mainly represented among automation companies.

The “breadbasket” states of Illinois, Minnesota, Colorado, and Iowa together accounted for 24% of the sample companies, with high representation in VRT analytics (50%), VRT applications (38%), equipment (33%), guidance (33%), and smart irrigation (29%). In sensors, 33% of sample companies came from the Midwest.

Intersection of Technologies. “One important dimension of the ongoing precision agriculture transformation not apparent from the results,” the authors write, “is the significant depth of intersecting technologies. Although firms were sorted into one of 16 categories, many would have been appropriately classified as suppliers of 2-4 technologies.” For instance, John Deere could have been listed under four categories: equipment; VRT; guidance; and with its 2017 acquisition of Blue River Technology, automation.

Coming Mergers? “Boundaries between software and hardware development are expected to dissolve if usage of IoT and big data algorithms in U.S. agriculture increases as expected,” the authors write. “One potential implication could be eventual consolidation among one or more large firms, not unlike recent mergers in agricultural chemicals markets.”

U.S. Trends Are Extendable to Europe. European firms, much like their counterparts in the U.S., enjoy extensive protection of intellectual property rights and also the potential for economies of scale. Additionally, thanks to rural development provisions of the Common Agricultural Policy, European companies may receive the benefit of incentives provided to farmers to adopt precision agriculture. “Differences in financial assistance policies, as well as further differences between the U.S. and European antitrust and regulatory environments, are expected to influence the rate and direction of technological progress in precision agriculture,” the authors write. “Consequently, the composition of Europe’s precision agriculture industry will differ from the U.S. industry but will have commonalities: many of the oldest firms will be among the largest, located in regions with low technology costs.”